Saturday, 30 March 2013

Thursday, 28 March 2013

Tuesday, 19 March 2013

Why Stockbrokers are aspiring to become Realtors - 2

In continuation with our previous post let us look at a comparison of equity and real estate as an asset class so that we can evaluate the products for which we offer services.

| Equity | Real Estate |

| Highly volatile | Stable |

| Liquid | Not easily liquid able |

| Coupled with foreign markets | Relatively decoupled. |

| Market prices determined by handful of FIs | Market prices determined by local economies and domestic conditions |

As an investment equity is highly volatile with daily fluctuations in price whereas Real Estate has a stable value which typically appreciates. It is not that sensitive to external forces.

Equity provides a liquid investment whereas real estate also is more difficult to liquidate on demand.

Equity is coupled with foreign markets and its movements are highly affected by the global scenario, and as we have currently seen it is also dependent to a large extent on foreign investors whereas real estate prices are relatively decoupled and governed more by domestic and local conditions, which was also seen in times of a global slowdown.

On comparing the merits and demerits of both the classes we realize that for a solid investment real estate is the more preferred option whereas for speculative and quick cash purpose equity is preferred. In the domestic scenario where people are risk averse real estate is becoming a more preferred option.

Thursday, 14 March 2013

Stock Brokers aspiring to become Realtors

With the current volatility in the economy on a global and domestic level we have seen the stock markets get hit. Stockbrokers have now started to look for alternatives to income generation. We shall have a series of articles on why stockbrokers are aspiring to become realtors or will aspire to.

The broker markets have seen a fall in average daily volumes to a nine month low in the wake of new tax rules for overseas investors. Prior to this the euro zone crisis had created havoc in the markets.

In an already difficult market another problem stockbroker’s face is today there is no differentiation between brokers and no unique value addition as organised broking has created a level field. Internet broking has further eaten into the independent broker’s market share.

On the other hand the real estate sector is still booming with potential. There is still scope for value addition unique to a broker. The competition by major organised players is barely a dent in the market. A stockbroker has already a network of clients who trust him which he can leverage. On comparing a person’s wealth invested in stocks and that invested in real estate we can see where the real bounty lies.

Stockbroking has reached a maturation point whereas real estate brokerage is entering the growth stage in terms of developing as an industry.

* Type REMAX and send it to 53456 to join the India’s Largest Real Estate Brokerage Network.

Sunday, 10 March 2013

Saturday, 9 March 2013

Thursday, 7 March 2013

Tuesday, 5 March 2013

Saturday, 2 March 2013

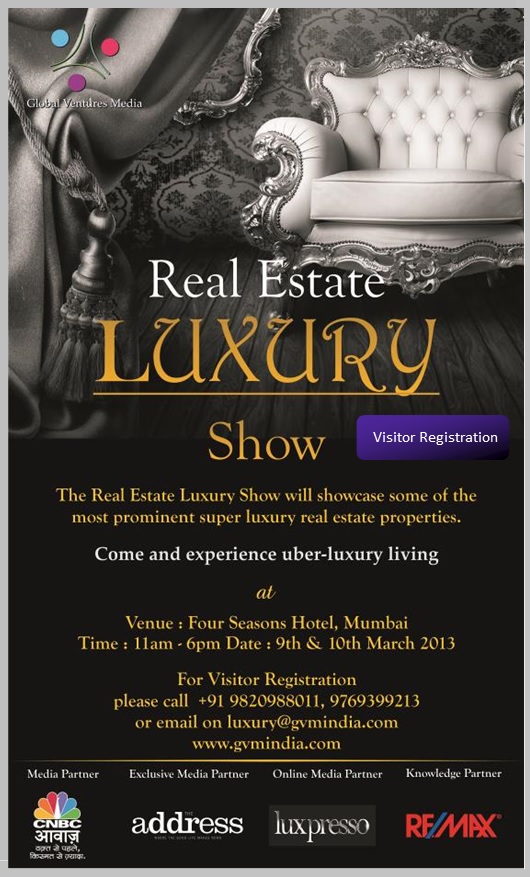

Real Estate Luxury Show - 2013, Mumbai

The Uber Luxury Living – Real Estate Luxury Show @ Four Seasons, Mumbai on 9th and 10th March 2013. RE/MAX is a knowledge partner for the show.

Subscribe to:

Comments (Atom)